Tracing Russia's 2024 planned and actual deficit funding

Russia is about to release its updated budget law for 2025, how did 2024's version pan out?

As I predicted in March, and despite official Russian denials, Russia’s budget needed revising to account for a much larger deficit. A similar thing happened in 2024, and their desperate scramble for funding in late 2024, resulting in very expensive borrowing, is partly why they are now in trouble in 2025.

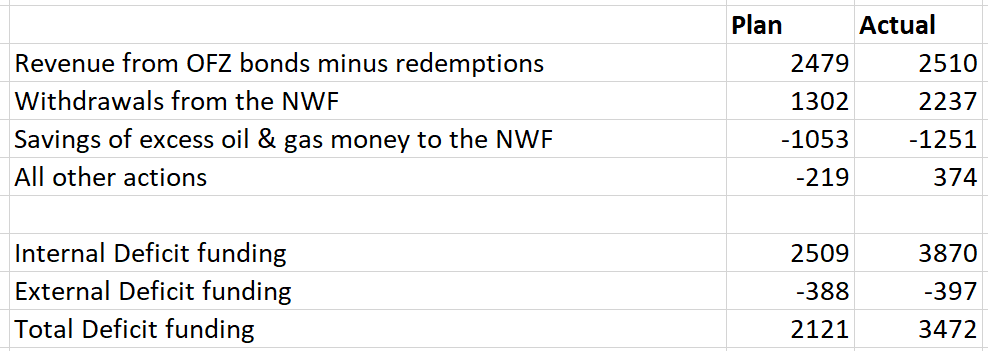

This is a technical post that is only going to be interesting for a tiny fraction of readers. It’s mainly to record my current understanding and be used as a reference for future, more interesting posts where I will want to refer back to this table:

The table shows how Russia borrowed a lot of money, but also needed to heavily drain its national wealth fund (NWF), and also remove net funds from other government accounts. The sections below explain why I believe the numbers in that table are correct, and I already discussed the NWF part and explained how it seems to include a major accounting shift related to how rising gold prices and a weakening rouble in December helped them out enormously.

1. The 2024 Plan

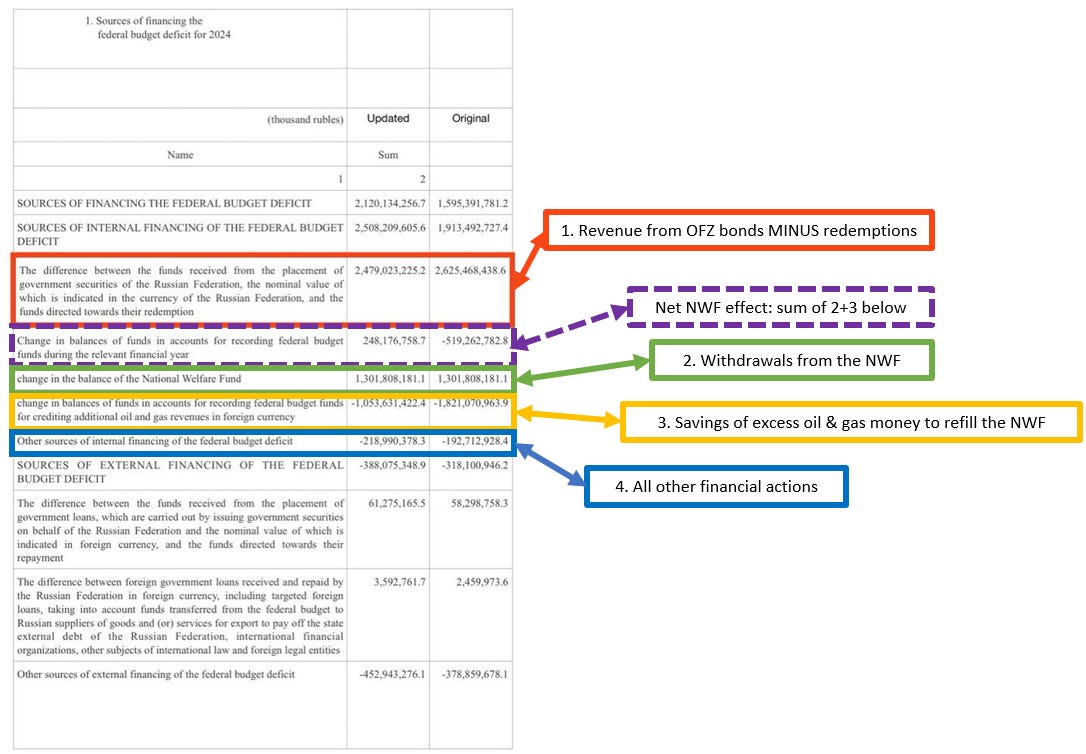

Here’s a screenshot from Prune602 on bluesky, where I’ve highlighted elements and what I think they are.

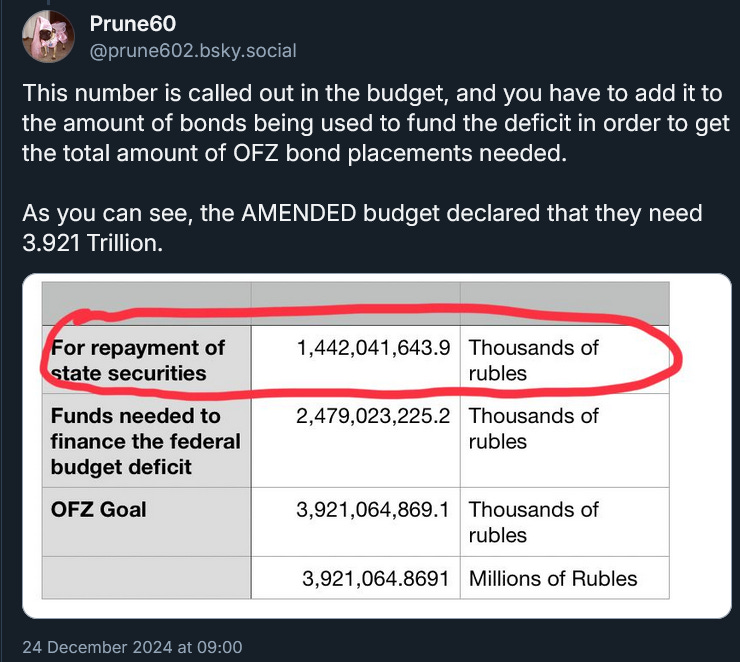

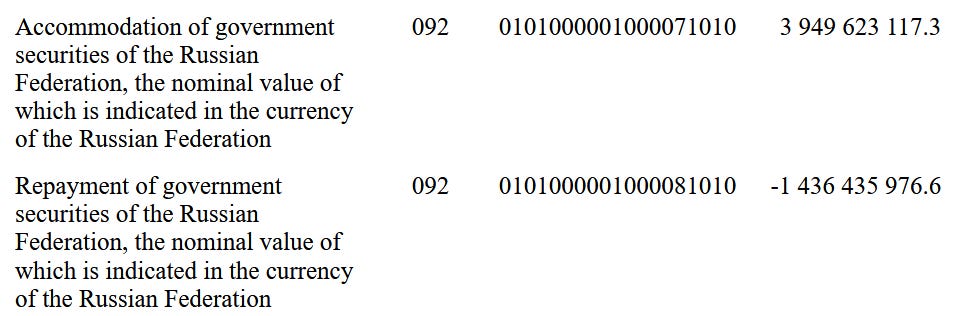

Two things I noticed from the table above: firstly, Russia aimed to raise 3.92tr roubles from selling new bonds, but only expected 2.48tr in revenue. This is because they had to pay off old bonds worth 1.44tr rub first. That’s shown here:

The other factor is that the deficit plan was 2.12tr rub, but they aimed to raise 2.51tr rub in “internal” funds. That’s because they have “external” debt, which is either in foreign currency or owed to foreign lenders, and on net they owed payments of about 0.39tr rub.

2. The 2024 reality

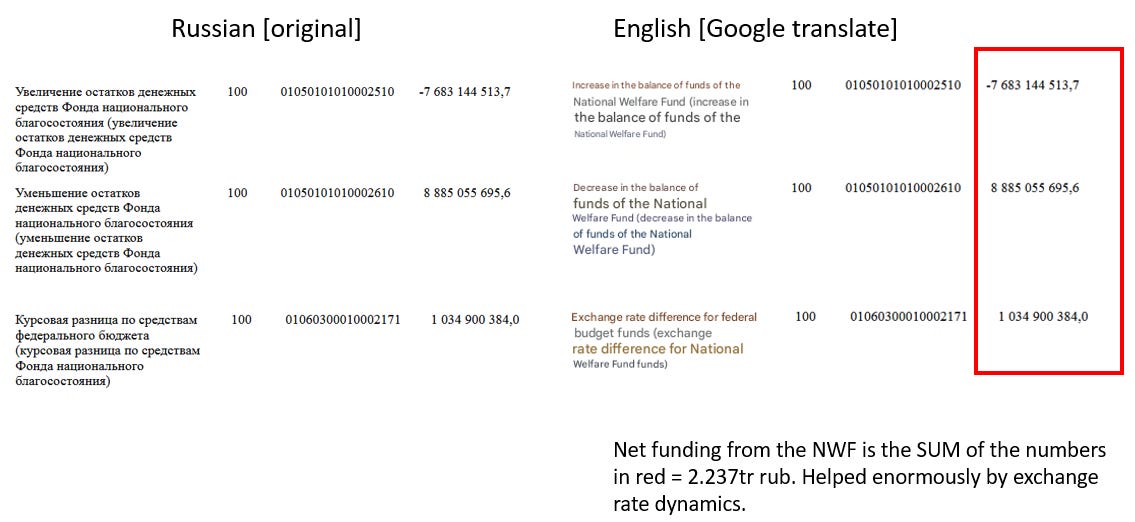

When 2024 happened, the final deficit was closer to 3.5tr rub, so they needed to find more money. I think I now have a grasp on what happened, and below I will show numbers from Appendix 6 of the finalised, consolidated budget law for 2024. Firstly, the withdrawals from the National Wealth Fund (NWF), thanks to accountancy games and the exchange rate, appeared to total over 2.2 trillion roubles. I am not certain yet about my interpretation here, but the budget documents seem clear:

Now that I’ve shown that I have checked various translations, I will just post the “official” English translation from the Russian government. Next, there are lots of changes in “other accounts”, but the treasury part seems to have found about 483 billion roubles by drawing down some “other balances”: 85.01tr rub went into accounts, but more was taken out:

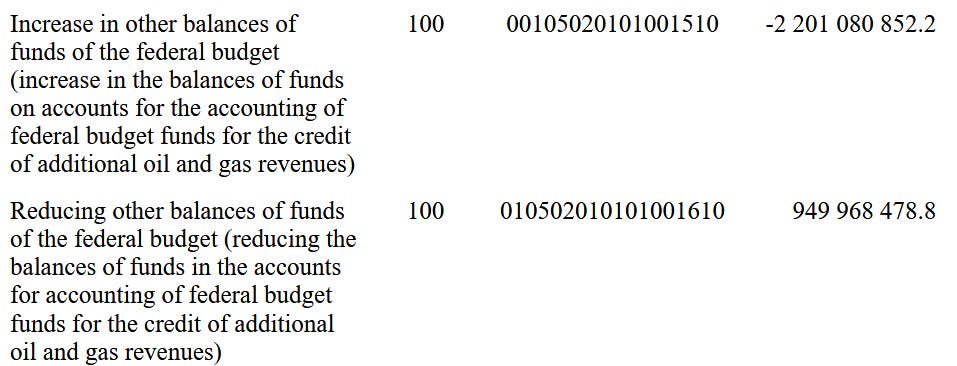

What about the “saving of excess oil & gas money”? I’ve talked about this previously, and I believe the system is this: when oil prices are above a certain level (roughly $60), Russia has a rule that they will take some of the oil & gas tax money and buy gold & yuan for a special account. The following year, it is deposited into the NWF. It seems like that was almost -1.25tr rub in their accounts, because they deposited about 2.20tr but withdrew almost 0.95tr:

And the big, final one was bonds (OFZ), with 3.95tr revenue and 1.44tr paid back to redeem old bonds, for a net of roughly 2.51tr in funding.

OK, this summarises and justifies how and why I read Russian budget documents the way I do - the numbers seem to add up in sensible ways so I will apply this interpretation to the new planned numbers.