The Russian budget and refilling the National Wealth Fund

The 2025 Russian budget appears to be even worse off than reported

There was a lot of surprise recently when in June 2025 Russia made a very large deposit into the National Wealth Fund (NWF). Based on Russian data, I think we can say that Russia saves up a fraction of oil revenues, counts them as budget expenses, and then can deposit them into the NWF the next year.

The NWF deposit means that last year’s budget deficit wasn’t quite as bad for Russia as reported. However, the performance this year means that their budget has worsened by more than expected: they have cut NWF savings by over 400 billion roubles so far, versus 2024. The June NWF deposit also included January & February 2025 income, the best months for oil prices, which should mean much smaller NWF contributions in 2026, unless oil prices soar later this year.

The massive June 2025 deposit

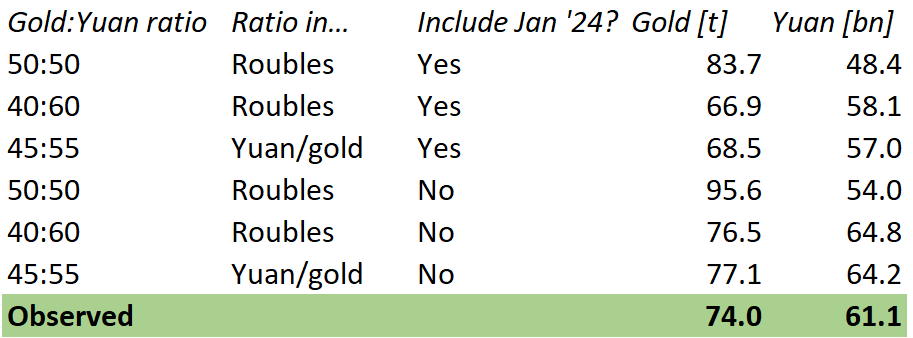

June 2025: Russia deposited 61.1 billion yuan and 74.0 tonnes of gold into the NWF, from “additional oil and gas revenues” between January 2024 and February 2025. I took the monthly 2025 oil and gas tables from 2024 and 2025 and want to highlight some details.

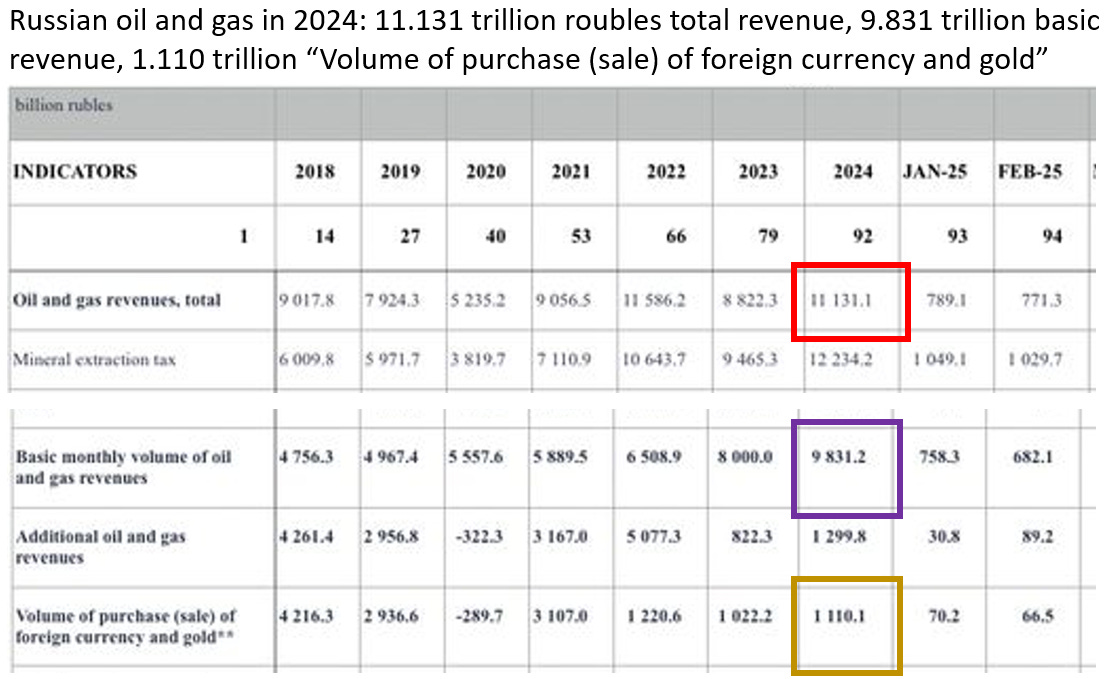

11.131 trillion roubles is the total revenue, made up of 9.831tr “basic” and 1.300tr “additional” revenues. At the same time, 1.110tr were devoted to purchasing “foreign currency and gold”. I think there is a good chance that they buy foreign currency and gold over time, and then at a certain point deposit the chunks into the NWF. Most recently in June 2024.

I took the January 2024—February 2025 monthly values for the roubles committed to “foreign currency and gold”, then took the Central Bank of Russia exchange rates and gold prices for the middle of each month, and calculated how much gold and yuan they might have bought. I considered different ratios: maybe they decide the fraction of roubles they will spend on each (e.g. split the roubles 50:50 and just buy as much gold and yuan as that buys), or maybe they have a fixed goal of the gold:yuan ratio (e.g. for every million yuan, buy 1.2 tonnes of gold, regardless of rouble price). They could also do more complicated things, which I ignore. The table below shows how much gold and yuan they could have bought following different “rules” about the ratio of what to buy. As an additional test, I included the effect of ignoring January 2024 because there were net sales in that month.

While I can’t exactly reproduce Russia’s numbers, they’re in the rough range. These numbers are consistent with the idea that Russia has a separate account that I haven’t seen publicly reported. This account holds gold and yuan, and it buys or sells based on the oil price and political decisions. It then deposits the gold and yuan into the NWF, and this is very likely what happened in June 2025.

Gold and yuan bought for the NWF seems to be counted as budget expenses

I have looked at Janis Kluge’s database of Russian budget expenses for 2025Q1 and cannot see an expense item for buying gold and yuan. It is possible that it is inside the “secret spending” category where Russia hides what’s going on, and I also noticed that the database expense total is slightly below the Ministry of Finance’s preliminary expenses estimate - by a similar amount to the reported gold and currency buys.

Without seeing a line item in the expenses database, I would normally assume that the currency and gold purchases are not part of the normal budget and are handled in a different way - in particular Russia does some weird stuff with its “budget funding appendix”.

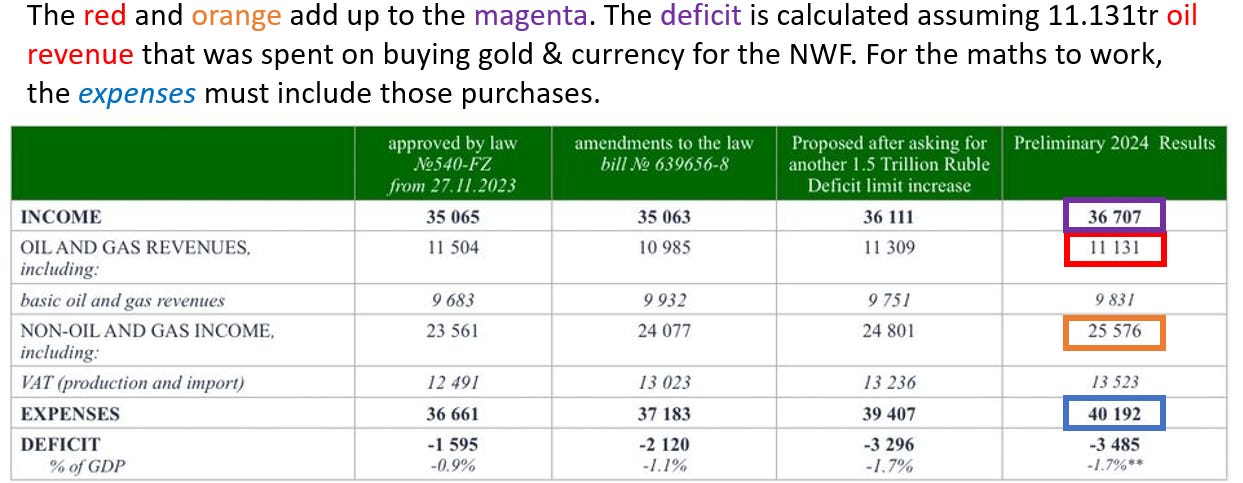

However, for 2024 the final reported budget deficit was calculated based on oil revenue of 11.131tr roubles. This is the total oil revenue from the table above, including that which was used to buy yuan and gold. The only way the reported deficit makes sense to me is if they balanced that out by including the yuan and gold buys in the expenses column too.

My speculation: does Russia have a lot of hidden cash and gold?

I don’t know the size of the temporary account for storing yuan and gold before transfer to the NWF. However, Russia is presenting a false appearance of stability and financial strength, because they know that a loss of confidence would result in even more expensive borrowing and further damage their economy.

If they had trillions more roubles sitting around in this account, then depositing more into the NWF would make their finances look stronger. It would be implied collateral for loans, meaning they could continue their record borrowing at a lower cost. The fact they didn’t put even more into the NWF suggests to me that they don’t have a huge extra reserve lying around in this particular account.

Consequences for the Russian budget

If my reading of the tables is correct, then last year Jan-July’s budget included 0.64tr in expenses to refill the NWF, versus 0.21tr this year. This suggests that Russian spending on other factors has grown by even more than expected - in effect their budget is 0.43tr rub more worse off than we already know about, compared with 2024.